How to Calculate and Reduce Customer Acquisition Cost

- Jeffrey Agadumo

- May 31, 2022

In this article, we will explore Customer Acquisition Cost, its importance, how to calculate and reduce it, and its relationship with Customer Lifetime Value.

Monitoring the success of your business is no small feat; it entails lots of frequent checks that convolute to indicate whether your company is moving forward or not.

Am I Tracking the Right Metrics?

Two marketers, Greg and Becky, walk into a coffee shop. Greg says to Becky: “how do you track important metrics that show the efficiency of your marketing?”

Becky responds: “Well, we have to check and measure traffic, number of new followers, signups, lead inquiries, click-through rate, and conversion to certain feature activations.”

“Oh,” She continues, “We also consider churn daily; we calculate revenue day and night and check our blog’s efficiency with SEO statistics.”

“Yes!” She goes on, “And might I add that we maintain very close contact with the customer assistants and sales team, we are measuring a lot, and I couldn’t even list half the metrics we go through to show marketing efficiency. “

If you are also a marketing specialist and can relate to Becky’s story, you may be missing something important.

You might want to grab a drink for this one because, after this article, you can kiss all the long hours of staring at data that tells you nothing goodbye!

What You Might Be Missing From Your Marketing

The activities highlighted by Becky are great, in fact, necessary to monitor progress. However, they are overwhelming as well.

The key is to identify your “ north star metric. “

This is a single metric that best indicates the long-term progress of your organization’s marketing goals and reflects your customer value.

Instead of tracking a hundred metrics that answer only a few questions, the idea is to track specific metrics that answer most of your questions.

Follow the Stars: Customer Acquisition Cost

A key “north star” that answers many questions is your Customer Acquisition Cost.

If you market proactively, then you are in the business of buying customers. Customer Acquisition Cost (CAC) is your company’s total marketing spend to acquire a new paying customer.

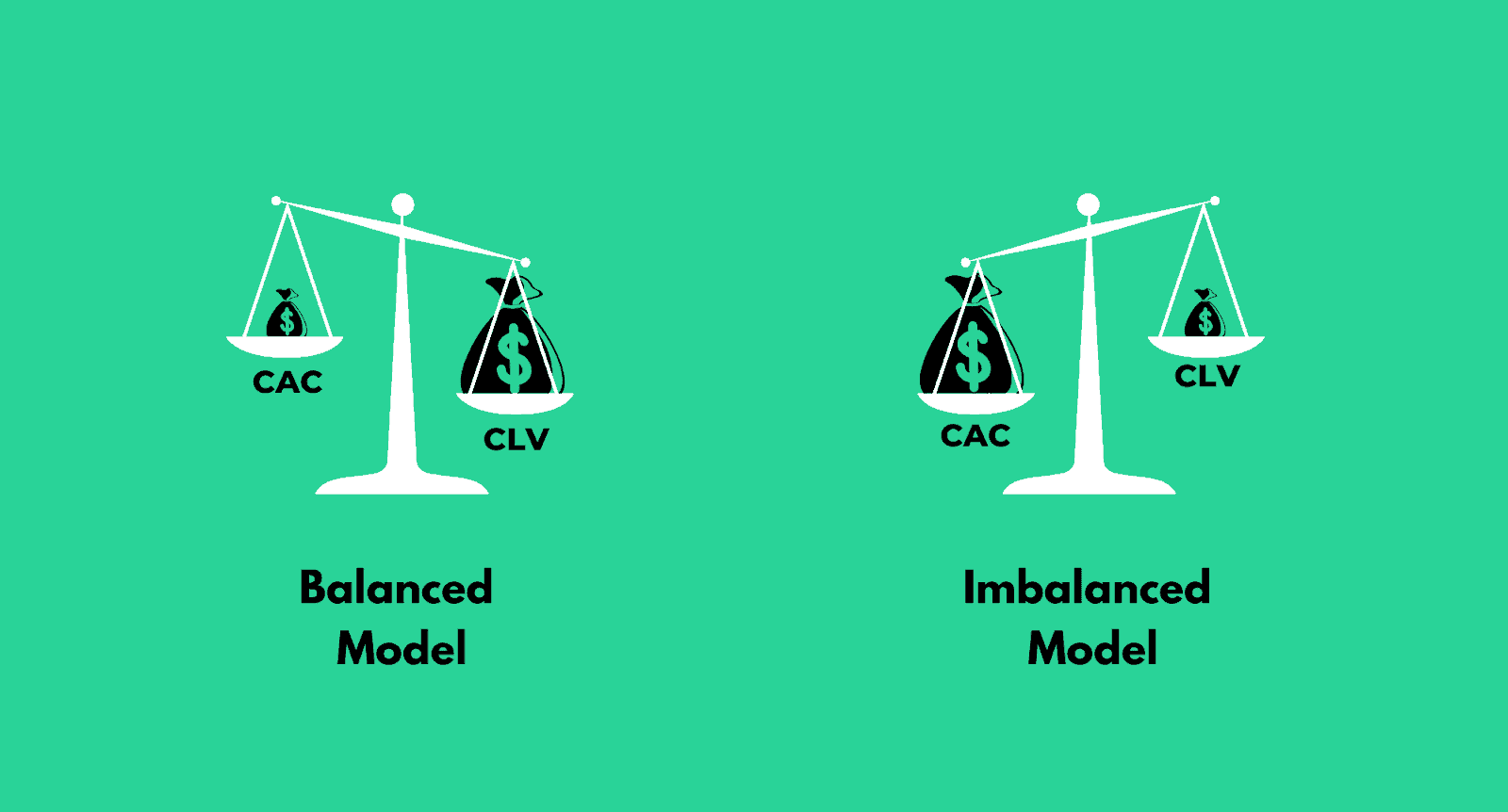

When analyzed with your Customer Lifetime Value (CLV), Tracking CAC is very significant. This is the cumulation of all purchases that a customer is likely to make throughout the lifetime of their buying relationship with your brand.

You can determine the minimum cost of acquiring a suitable customer, then compare that cost to how much revenue that customer will generate for you throughout the lifetime of their relationship with your brand.

“A well-balanced business model requires significantly less CAC than LTV.” – David Skok

If the CLV is higher than the CAC, your business is likely to hit its revenue goals. And if it is less, you might need to recheck your business model or campaign.

Why Customer Acquisition Cost is Important

Here are some reasons why Customer Acquisition Cost is essential:

1. Visibility : Calculating your CAC exposes how acquisition costs affect profitability; if CAC is too much, then your profits are reduced, but if it is low, your profits could multiply.

It reveals if you are spending too much to acquire new customers. You can track how much value you are getting for every dollar spent.

2. Improvability : If CAC reveals profit and loss, it also reveals opportunities for improvement; you can streamline your processes to create innovative acquisition strategies and better retention plans for new customers.

Improved acquisition strategies help bring new customers on board, and if done right, it increases your overall profitability and lowers acquisition costs.

Better retention also leads to happier customers, and happier customers attract new customers by raising awareness of your brand.

3. Relatability : Greg could process all Becky said to him quickly; let’s continue our scenario from the introduction, shall we?

Becky walks into the office after coffee, and she is informed that the C-suite executives are having a meeting, and they need someone from marketing to update them on the progress of the recent campaign.

How do you think they would react if Becky repeated all she said to Greg?

If she says this, however: “ Efficiently acquiring customers is reducing our cost and improving our profitability. ” she proceeds to explain that the progress becomes more relatable to everyone regardless of expertise.

How to Calculate Customer Acquisition Cost

You can calculate CAC for a campaign on a single channel, one that cuts across multiple channels, or for a specific time.

To calculate CAC:

add up your marketing expenses (me) and your sales expenses (se) and additional expenses (ae), then divide the total sum by the number of customers acquired (ca)

CAC = (me + se + ae)

ca

where,

me refers to Marketing expenses.

se refers to Sales Expenses.

Some marketing and sales expenses include production costs, publishing costs, ad costs, cost of marketing teams, technical costs, and inventory upkeep costs.

How to Reduce Customer Acquisition Cost

A 2022 survey by Marketing Charts on 118 retailers showed that 57% said that rising customer acquisition costs threaten their 2022 sales goals.

We can conclude that CAC is a concern to most of them, and reducing it should be for you.

Here are some tips to help you with reducing CAC:

1. Awareness

With personalization, customer engagement has become the soul of marketing. It eases your customers into your brand and captures their attention to make sure they keep coming back and spreading the word.

Create awareness first by gathering data about your target audience and then tailoring your brand personality to the data, making it relatable and easy to connect with you. This could be in shared values, brand stories close to home, or adopting popular trends; keep it original.

Then examine and improve your customer touchpoints to make them feel valued and watch them adopt your brand.

It doesn’t cost much to value a customer, but the result will increase your customer adoption rate and Lifetime Value.

2. Retention

Companies in the U.S. lose $136.8 billion every year to preventable consumer switching. Good customer retention practices can reduce that loss.

The secret is in good customer experience. It costs less to retain an existing customer than acquire a new one. Existing customers are also five times more likely to buy than new customers.

Use content, email, and social media marketing to stay in touch with customers and engage them often when they are not buying. Constantly release great content, helpful tips, free ebooks and materials, and free trials on your product.

3. Retargeting

Retargeting is done to remind customers to complete purchases or inform them to purchase new product offerings.

You can retarget customers based on your site’s specific pages, and you can deliver personalized ads that they can’t ignore.

Not every customer is moved by the same incentives. Segment your audience based on consumer behavior, e.g., Cart abandoners, recent visitors, one-time purchasers, etc. Then retarget them with offerings that fit their specific interests…

4. Optimization

Analyze your copy advertising. For example, compare ad copy performances using Google Search Ads 360 .

This test is fully automated and focuses on accurately measuring and comparing ad performance based on the ad copy. Use it to determine the ads in an ad group that is helping you hit your conversion goals the most.

You can always pause ads that are not performing and model them after ads that are performing to get similar results.

5. Automation

There is automation in every step taken to reduce CAC. CRMs help you monitor customer touchpoints across multiple channels, consumer behavior, demographics, and sales team contact data.

Even if your product or service is not unique, personalizing your brand to your customers will drive down your CAC and drive up your profitability.

Connecting your business to a CRM manages all your marketing data in one place, giving you clearer visibility of buyer behavior. With this information, you can engage every segment of your market with the right content and retention strategy.

How to Ensure Quick Access to Your Marketing Data

CAC is the cost of acquiring a new customer, and CLV is how profitable that customer will be to you. CLV must be higher than CAC to be counted as profitable.

Calculating CAC can often help you streamline your processes to drive down costs.

A recurring theme here is automation; employing the right system like Datameer, a Multi-Persona and Collaborative data transformation tool that is Snowflake native, might be that weapon your arsenal needs to change the game.

With Datameer, you will get quick access to your marketing data from any source connected to Snowflake and easily streamline your processes to drive down your CAC.

Like the CAC metric, Datameer is easy to understand and lowers your data engineering costs, giving you an edge over your competitors. It is the only data transformation tool with a no-code drag-and-drop user interface for your team.

Regardless of coding and SQL skills, your team can save time and cost on data engineering and produce effective, on-time metrics that meet your marketing goals.

Get access to Datameer and begin to see results immediately!