Low-Code Data Transformation Pipelines

Leverage the best of No-Code and SQL to integrate, enrich, clean, and automate your data transformations with unmatched speed and simplicity. Enterprise grade. Cloud-Native.

Trusted by top global enterprises

Trusted by top global enterprises

Keeping all of your data in one place, on Snowflake

Datameer was purpose built for Snowflake to streamline your data processes, reducing duplicate work and keeping your data accessible.

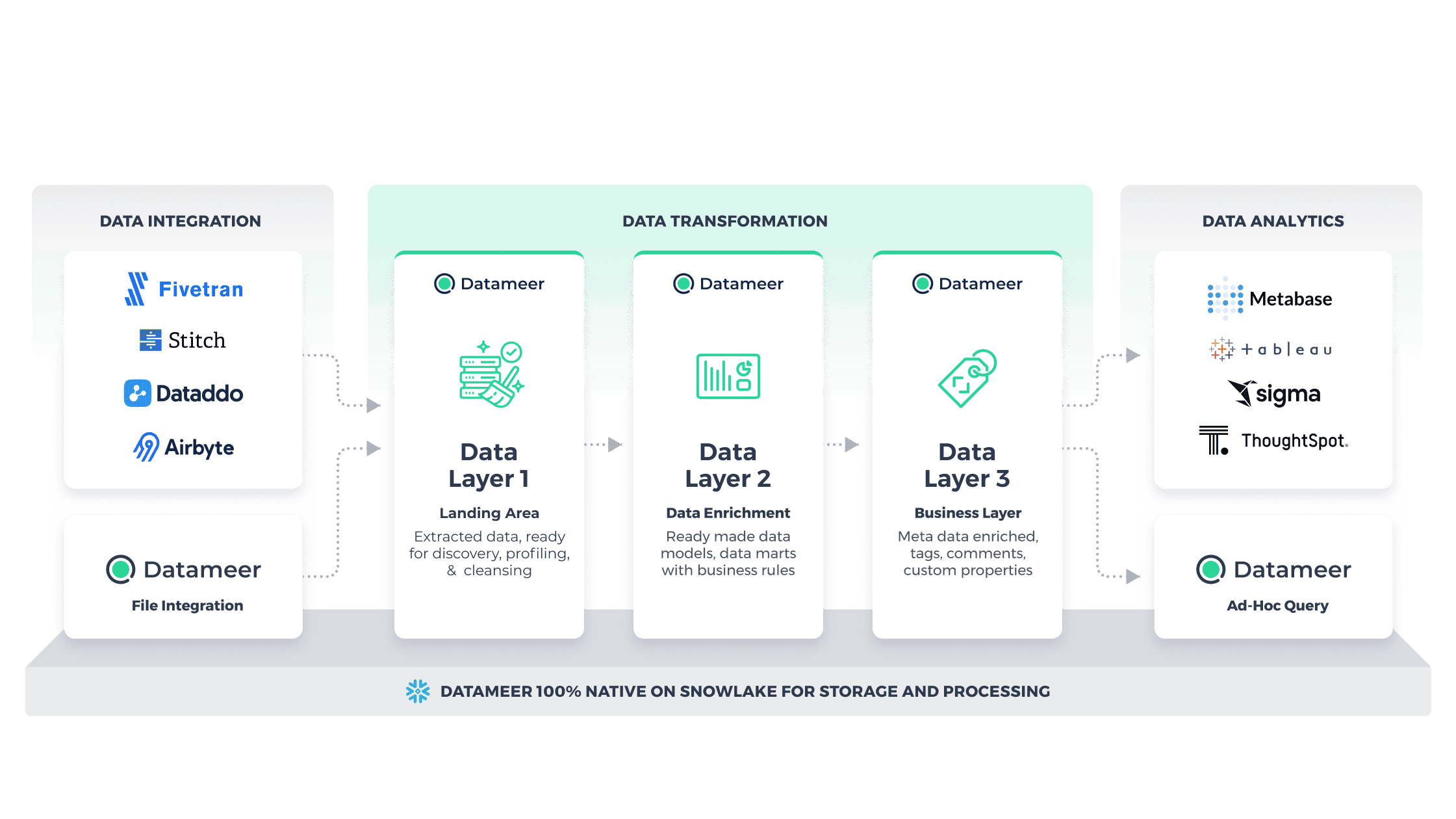

Modern BI Architecture with Datameer

Datameer integrates seamlessly with your modern data stack, offering advanced data transformation, enrichment, and automation capabilities to drive unparalleled depth in insights.

Get started in minutes

- Cost Savings: No installation, maintenance, infrastructure, or IT labor costs.

- Instant User Activation: Users can start in seconds.

- Continuous Innovation: Access new features seamlessly.

- Universal Accessibility: Works on any desktop, laptop, or OS.

Real-World Results From Datameer Users

Build Your Modern Data Stack in One Day

Learn from our experts how to get started with your data journey

Get the guide